Are you new to the

Japanese tax system?

Welcome to our friendly firm!

Japanese Tax advice in English.

PRACTICE AREAS

Corporate Tax

Individual Income Tax

Withholding Tax

Consumption Tax

Inheritance Tax

Gift Tax

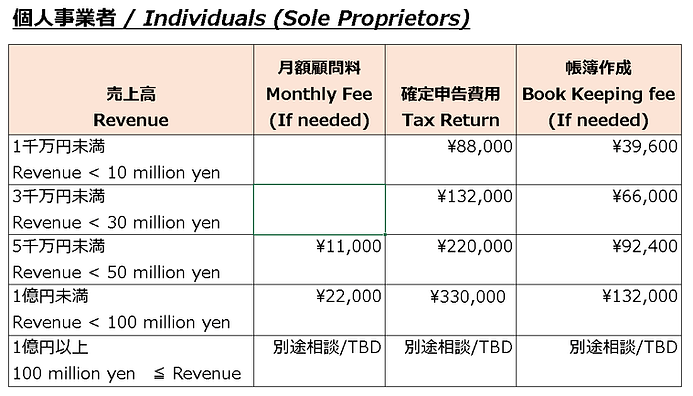

PRICE LIST(Tax Included)

Consultation Fee for Non-Clients

Answering your tax questions and solving your problems are important to us. Therefore, we do not offer free sessions even for initial consultation or questions by email or phone, other than inquiries about our service offerings. We are happy to welcome questions from non-clients and possible future clients. Our consultation fees are as follows:

--Consultation in person, remotely or by email--

-

Consultation during normal period: JPY 22,000/hour (Extension: JPY11,000/30 min)

-

Consultation from 1 Feb to 15 Mar: JPY 33,000/hour

-

For those who have a monthly contract: FREE up to 2 hours/month

-

Annual contract for unlimited consultations only: JPY 100,000 /month

-

Attending a tax audit on your behalf: JPY 55,000 /day

Advisory Fee

General fees are as follows (subject to change depending on overall time spent).

A book keeping fee is applied for those who do not use accounting software. We recommend Epson, freee, and Xero.

(Excel sheets are only accepted for Individual sole proprietors.)

※ To be applied Corporates list for Doctors and Dentists

*Revenue total includes income from property rental.

33,000 yen will be added for helping set up a business / company and submitting documents to the tax office.

22,000 yen will be added for those who have a House Loan Deduction for the first year.

110,000 yen will be added for those who have Capital Gains / Losses income. (Properties, Stocks)

55,000 yen will be added for Stock (Dividend and Interest) income.

11,000 yen will be added for Retirement allowance and Occasional Income.

22,000 yen will be added for those who have applied for a 650,000 yen deduction for Blue Return Taxpayers.

Filing a simple case for directors of our Corporate clients will be 11,000 yen for a white tax return, 22,000 yen for a blue tax return. An extra fee will be charged if you have business income, property income and capital gains income, etc.

55,000 yen will be added for administration work for being a tax representative for non-Japan residents.

33,000 yen will be added for helping to get government subsidy / grant.

22,000 yen will be charged for those who have Foreign Tax Credit.

55,000 yen will be required for RSU (Restricted Stock Unit) vested.

An extra fee of 15% will be added for clients who apply after 1st March.

A fee of 11,000 yen per hour will be charged for additional required work.

*All fees will be proposed to each client as details of the work become evident. Our firm reserves the right to propose additional fees based on evolving client requirements. We will endeavor to discuss these requirements.

About me

Mika Kume

Originally from Yokohama, currently living in Ota-ku, Tokyo

Experience

Kume Mika Tax Accountant

Self-employed Jul 2019 – Present

Partner

Kume Tax Accountants LLP

Jan 2012 – Jul 2019

Co-Ordinator

Ernst & Young Singapore LLP

Nov 2004 – Dec 2011

Singapore

Tax Accountant

Kume Tax Accountants

Jan 1997 – May 2001

Admin Officer

Mitsubishi UFJ Lease & Finance Co. Ltd

Apr 1983 – Dec 1988

Qualifications

-

Certified Public Tax Accountant Japan (Dec 1997)

-

Association of Chartered Certified Accountants (ACCA) (Partially passed in 2005) Subject passed: AB - Accountant in Business, MA - Management Accounting, FA - Financial Accounting)

Hobbies

-

Triathlon, Trail Running, Golf and Ski

-

13-time Ironman triathlon finisher

-

Finished Boston, New York City, Tokyo, Singapore, Melbourne and many other marathons. (Beyond count).

-

Completed 250km self-supported stage footraces in Sahara, Gobi, Atacama deserts and also in Nepal.

Although Mika loves her sports, her clients always come first.

Contact

Location:

Kume Mika Accounting Office

〒146-0092

4-27-1-404 Shimomaruko

Ota-ku, Tokyo

Email: meeks[]mikakume.com

(NO junk emails. Please change [] into @when you email us!